Cryptocurrencies: a digital ‘asset’ for The Bahamas?

23 August 2022

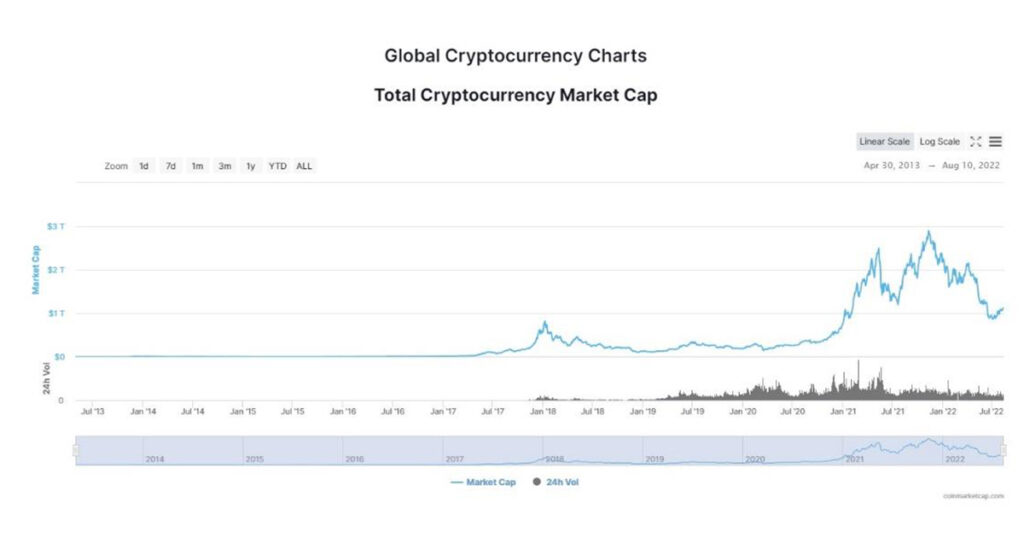

The increasing use of cryptocurrencies such as Bitcoin and Ethereum has led them to peak at more than $2 trillion in value, with the current market cap standing at around $1 trillion.

This is hard to ignore and has prompted some countries like The Bahamas to prepare ‘crypto-friendly’ regulation with the aim of becoming hubs for the international cryptocurrency market. This positive view runs parallel with sceptical news headlines about digital assets and recent falls in value. It is therefore important to separate fact from myth in such a significant area.

Kreston Bahamas examine the rise, risks and potential of cryptocurrency and other digital assets.

How they work

Crypotocurrency has come a long way in a short time as the graph shows. The concept can be traced to the 1980s, but it really took off from 2008 with the launch of Bitcoin. Cryptocurrency is a type of computerized or virtual cash that is obtained through encryption. This is one its key strengths as proponents argue it is almost impossible to forge or double spend. Another benefit is that it is a decentralized asset thanks to the underlying blockchain technology they are built on. This is a transmitted record supported by a separate organization of computers. They are typically not provided by central authority banks so are ostensibly immune from third-party interference.

Source: CoinMarketCap.com

Emerging markets

The last few years have seen a more widespread acceptance of cryptocurrencies worldwide as various countries and organizations use them as a payment platform. The potential advantages such as security, decentralization, and scalability that digital assets have over fiats and traditional financial systems have largely fuelled their rise. Another contributing factor is the activities of analysts, who can use the volatile prices that cryptocurrencies frequently display to generate significant returns.

Other Digital Assets

Cryptocurrencies are one category of ‘digital assets’ which are any computerized resource with a complex structure that can generate value. Other types of digital assets are explained below:

DeFi

Decentralized finance (DeFi) consists of applications and distributed conventions built on decentralized blockchain networks that require no access rights. They leverage contracts and ‘shrewd agreements’ which are automated enforceable agreements that don’t require members to know each other before a cryptocurrency transactionies. Anyone with a web connection can access them to conduct financial transactions.

NFTs

Non-Fungible Tokens, fundamentally imply that the resource’s token is exceptional and requires verification to show that it is real and intended for its owner. NFTs are frequently used for things like social accounts and craftsmanship as a means for customers to claim unique resources.

Asset-backed Tokens

Using resource-backed tokens, conventional, real resources like gold and oil can be tokenized and traded among users on the blockchain.

Tokenized Commercial Real Estate

Real estate can now be tokenized as a computer resource, just as resource-supported tokens. This method involves increased liquidity, easier access to proof of ownership, and improved exchanges. It may make ownership opportunities available to more people, whatever their investment size.

Regulation

The biggest challenge for regulators after Bitcoin’s surprise rise in value is to stop its use for online fraud, money laundering and terrorism. Although experts claim these concerns are valid, the US government has made some effort to develop implied laws for digital currency management:

- Anti-Money Laundering (AML) compliance for digital currencies refers to the laws, policies, and systems that prevent criminals from using cryptocurrency platforms to hide illegally obtained money by exchanging them into cryptocurrencies.

- Combating the Financing of Terrorism (CFT) regulations are similar as they are government laws specifically designed to prevent terrorists and those under government supervision from having access to funds or laundering money through banks or other financial institutions. Since cryptocurrency can make it easier for criminals to launder funds, cryptocurrency platforms must register with regulatory agencies such as the Financial Crimes Enforcement Network (FinCEN) and adopt a proper AML/CFT program.

The Bahamas – ‘DARE’ boosts interest

Cryptocurrency platforms are always looking to pitch their tents in countries with friendlier AML compliance and easy-to-navigate regulations. Countries such as The Bahamas and Singapore are known for being crypto-friendly, and to further encourage active participation in the Bahamas, the country passed the DARE Bill in 2020.

The DARE Act (Digital Assets and Registered Exchanges) provides a comprehensive legal and regulatory framework to allow cryptocurrency exchanges to operate in the country. The Act was developed after consultation with major crypto platforms, industry stakeholders, and the Securities Commission of The Bahamas.

The Act was adopted after the Government examined how other competitive cryptocurrency

Legislations in different countries work and how it can improve to create a new and better

opportunity for crypto investors and platforms.

The DARE Act’s pro-cryptocurrency spirit and solid legislative structure has sparked a huge interest in The Bahamas as being a “welcoming crypto hub.” A major boost was given when the popular cryptocurrency exchange FTX transferred its headquarters from Hong Kong to the Bahamas because of the DARE Act.

It is the exchanges dealing in digital currencies and assets which are responsible for compliance. They must have compliance officers who enforce the required checks and routinely monitor transactions to ensure they are not related to money laundering or terrorist activities. Suspicious activity must be reported and the transactions tracked.

Our recent experience

As a professional chartered accountant (CA) and advisor, a client was recently referred to me on a prospective engagement of a fund that will be exclusively invested in the crypto market. The client insisted that the portfolio is low-risk and profitable, so I should not have many concerns, since much of the investment portfolio was made up of stablecoins. Although the coins were majorly stablecoins, I advised the client on the general volatility of cryptocurrencies, including stablecoins.

Stablecoins are digital currencies whose values are pegged to another asset to ensure ‘stability’. They are based on smart contracts and meant to hold the same value as the asset they were pegged to regardless of where or when it is used. An example is the USD Coin (USDC). Stablecoins are designed to be “non-volatile” since their values are not subjected to the fluctuations experienced by non-pegged cryptocurrencies. If the coin it is pegged to increases, its value also increases. For instance, USDC is pegged using the US dollar. Thus, if the dollar value goes up, the value of the USDC will correspondingly increase and vice-versa.

Stablecoins are backed by fiat currencies such as the US dollar and Euro. This also means they have no transaction fees as they are completely decentralized. As such, they serve as an ideal mode of exchange for online transactions and payments. As a matter of fact, they are accepted as a valid form of payment by many merchants, including major retail giants like Walmart and Amazon.

While explaining the potential risks and rewards to this client, I clarified that stablecoins, often deemed ‘stable’, can also crash and collapse, especially those backed by algorithms and not by reserve assets like fiat currencies. This is because they struggled to gain regulatory acceptance and maintain a stable value as their algorithmic peg mechanisms may not be able to perfectly fix their values. However, the case of stablecoins backed by reserve assets is slightly different as their risks can be managed due to the safety and liquidity of the reserve assets. The irregularities in the rules and regulations backing stablecoins and cryptocurrencies, in general, are therefore an extremely vital factor in determining the success of a cryptocurrency project. This was evident in the break in Terra’s peg and the crash of the LUNA ecosystem in May.

Since its inception in 2018, LUNA has been a popular digital asset. Despite being listed on several crypto exchanges, the coin experienced a major crash in May this year. LUNA’s crash can be linked to the fact that, as an algorithmic stablecoin, it is not backed by reserve assets such as fiats. As explained, when fiats do not back stablecoins, they stand a higher risk of crashing.

UST, the stablecoin of Terra, was backed by its sister coin, LUNA. During the rise in interest rate and a broader crypto market meltdown, over $2 billion worth of UST was unstaked, and many were sold. This huge selling pressure caused LUNA’s total market cap to fall, consequently leading to the collapse of the stablecoin, UST.

Before the collapse of LUNA, it was pegged to the TERRA USD stablecoin, which had a 1:1 value with the US Dollar. After the crash, users lost trust in the platform and were no longer willing to invest in the coin. Despite this, the LUNA team decided there was no reason to give up on the project and chose to develop a second version of their platform to serve their users better. This led to the development of LUNA 2.0. It is important to note that although LUNA was restructured to LUNA 2.0, the damage was already done as the cryptocurrency couldn’t attain its former stance and value.

However, even with the recent episodes of failed cryptocurrency projects, the hype around cryptocurrency as a viable investment option and a disruption in the digital finance space keeps gaining momentum. Despite the recent collapse of the TERRA LUNA ecosystem, investors continue to up their crypto portfolios. The reasons for this massive trust are not far-fetched and can be attributed to the following:

- Cryptocurrencies are a relatively new investment asset class, making them volatile and riskier than traditional investments such as stocks and bonds. However, many believe that as the cryptocurrency market grows, the overall level of risk will decline as the assets become more established and less volatile. Furthermore, Technical Analysis (TA) and Trend Forecasting tools can help you identify the most promising investment opportunities and minimize your risk exposure.

- One of the reasons for the interest in cryptocurrencies is the potential for high returns with minimal risk of loss compared to traditional investments such as stocks and bonds. Cryptocurrencies generally have no fees and low capital requirements, making trading more liquid and easier to manage. For example, Bitcoin trading fees are typically less than $1 per transaction. At the same time, the minimum amount required to open an account at a major crypto exchange is usually only a few hundred dollars.

- Another crucial factor is that unlike traditional currencies like the Euro or US dollar, the value of cryptocurrencies isn’t tied to any country’s economic performance or the stability of its banking system. The transactions are recorded on the blockchain – a decentralized ledger shared among all network participants.

- Finally, in certain jurisdictions, cryptocurrencies are considered legal tender. They are used to buy and sell goods and services online and by individuals and companies for investment purposes. Having them could serve as an alternative method of payment.

These reasons and more continue to appeal to investors on the potential that this ‘trendy’ and newly unlocked digital asset sphere promises to bring, making it extremely difficult for cryptocurrencies to be ignored in the financial space.

Auditing

Auditing firms can be reluctant to take on companies holding significant amounts of crypto assets, mostly because the blockchain industry provides novel, difficult, and risky areas that some audit firms are unable to manage. From a financial reporting perspective, it is difficult to follow the price movements of cryptocurrencies and there is currently not much guidance addressing digital assets.

Three key areas of concern with crypto assets are existence, ownership and valuation. These are early days and firms will become more familiar with the crypto market. In the meantime, the fundamental considerations for evaluating digital assets remain the same.

During 2019, ‘the International Accounting Standards Board (IASB), concluded that cryptocurrency meets the International Accounting Standards (IAS) 38 definition of an intangible asset and where it is held for sale in the course of ordinary business, it falls under IAS 2 Inventories’.

Both the IASB and the Financial Accounting Standard Board (FASB) that governs the generally accepted accounting standards of the United States, agreed that there in no clear path, at the moment, to universally address this subject. As such, have espoused that to determine the right accounting treatment, you must consider the substance and financial impact of use of digital assets.

However, auditors are responsible for providing sufficient evidence relevant to the board’s assertions on the fair presentation of the financial statements. But because of the nuanced concept of regional difference, the way advanced resources are evaluated is distinctly unique.

Auditors can mitigate these rising issues by:

- Using their expertise to collaborate with all parties, establishing a comprehensive strategy for tolerating, organizing, and carrying out assessments of computerized resources. They can also show that maintaining clarity and confidence in the capital business sectors is essential.

- Applying the best logical thinking and advancing successful and deliberate evaluation while helping to develop new procedures and systems.

Challenges

It’s been a turbulent time recently in the financial world and for investors especially. The crypto market has not been immune. Since its all-time high of over $68,000 in November, Bitcoin’s price has declined by nearly half in 2022.

The crypto market has suffered from the larger market selloff of risky resources as financial backers battle with high expansion. The conflict in Ukraine and changes in US financial strategy are also significant contributing factors. Some experts are warning that the worst is yet to come.

This downturn is simply a reminder to financial backers that crypto assets come with increased risk and unpredictability, particularly during the monetary and political fragility we are now. No matter how bad the market may be, it is not time to panic. Although it may take some time, a bounce-back is always in view. To stabilize the market, those who have Bitcoin will have to keep it, while others will have to acquire it again. This has happened before, and it will happen again.

Bottom line

The crypto market can be volatile and unpredictable. But its growth has been unprecedented. If it becomes more mainstream and goes beyond finance into sports, music, arts, real estate, and gaming, you might be dealing with crypto sooner than you thought.

The pro-active move by The Bahamas to welcome in the crypto market could prove to be a catalyst for change, providing benefits on many levels. Cryptocurrencies don’t have to be cryptic. Dealing with such a unique financial platform makes getting the right information and advice vital in anyone’s crypto journey.

Pretino P. Albury

Partner

Kreston Bahamas

Weblinks:

Digital assets: what are the accounting issues? | ICAEW

What is Blockchain Technology? – IBM Blockchain | IBM

Coinbase, the largest crypto exchange in the US, faces a potential SEC investigation – Vox

The DARE Act Opens the Door for New Industry in the Bahamas | STEP