Cryptocurrencies: what do the latest trends mean for the accounting profession?

12 June 2023

Cryptocurrency has been the subject of both hype and scepticism throughout its existence.

Its enthusiasts see it as not only an opportunity for high returns on investment but also a ‘democratising’ economic force, decentralised from any bank or state; its critics warn of regulatory concerns, high volatility, and over-optimism.

Against this backdrop, it’s no wonder many accountants and auditors are concerned about working with clients with crypto portfolios. That said, investors are still committed to this market — and ultimately, in my view, future developments in blockchain and cryptocurrency have the potential to revolutionise the accounting industry.

Therefore, accounting firms can’t afford to stay in the dark about these technologies. To future-proof your firm and give your clients the advice they need, you must understand the cryptocurrency market.

Cryptocurrency trends in 2023

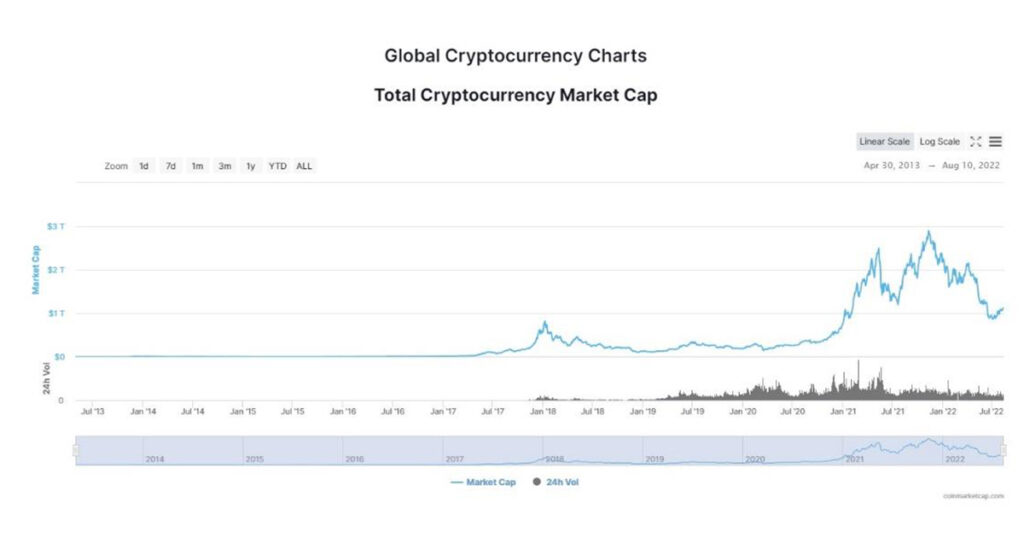

Overall, faith in cryptoassets has been shaken by events of the past year, with a string of failures culminating in the collapse of crypto exchange FTX in November 2022. Bitcoin, the most popular and widely-known cryptocurrency, ended 2022 at a price of £13,662.59 – a 72% decrease from its peak of £48,005.97 in November 2021.

This volatility is the biggest challenge of the crypto market, both for individuals whose assets are affected by price fluctuations and in terms of its effects on the broader global market. Other asset classes — such as stocks and securities — have a firm place in the accounting practice, primarily because they’re heavily regulated by relevant bodies around the world.

In contrast, cryptocurrency regulation is generally limited, only covering certain aspects of specific digital assets (resulting in many anomalies).

However, several major countries are committed to changing that to increase oversight of the market and better protect investors – especially in light of the FTX crash. The UK Government recently published new plans to regulate cryptoasset activities, for example, while the EU is in the process of finalising its own rules.

Meanwhile, President Joe Biden recently released an executive order and a proposed framework for regulating cryptocurrency in the US. As a result, the Financial Stability Oversight Council has called on the United States Congress to pass legislation specifically targeting stablecoins, crypto spot markets, and regulatory arbitrage.

Various state banks are looking at the potential of establishing a central bank digital currency (CBDC): a digital currency a country’s central bank issues. The Bahamas was the first country to do this, followed closely by China, whose digit yuan, e-CNY, has already participated in transactions worth about $14 billion.

Are people still investing in cryptocurrency?

Future regulation aside, the dramatic fluctuations of the cryptocurrency market and the failures of the past year have led many to wonder what the future is for this technology.

From what I’ve seen, investors are still overall committed to cryptocurrency: they’re just more strategic now in the investments they choose, favouring those backed by underlying, measurable and sometimes tangible assets, or investments with the greatest utility.

There has also been a shift in protecting crypto investments by staking their holdings. Offline storage solutions, such as cold wallets, are also being used to keep crypto investments safe from hackers or companies that go bankrupt. Even with the recent episodes of failed cryptocurrency projects, the hype around cryptocurrency as a viable investment option and a disruption in the digital finance space is still gaining momentum.

The opportunities of cryptocurrency for accountants

Aside from needing to understand cryptocurrency to advise their clients, accountants stand to benefit from this technology in several ways.

Upskilling

In our industry, we all know the importance of continuous professional development.

Gaining a greater understanding of cryptocurrency will help to keep you relevant in a highly competitive marketplace and obtain the skills required in a fast-changing, client-focused environment.

Involvement in standardization

With this in mind, we have a unique opportunity to set ourselves apart and

demonstrate our own expertise as lawmakers build rules and regulations around cryptocurrency. By developing standards that protect users and those operating in this space, our profession can help to build public trust.

With annual transactions easily verifiable through the blockchain, some might argue that this technology renders auditing obsolete. We need to be in front of this possible assertion, bringing expertise and irreplaceable human insights to the table.

Consulting for cryptocurrency

Cryptocurrency offers the opportunity for a new revenue stream and an increased customer base.

By integrating our understanding of blockchain with our knowledge of auditing applications, we can develop more effective and efficient ways to deliver our accounting and auditing solutions, including regulatory compliance.

Accounting for cryptocurrency

From a financial reporting perspective, accounting for cryptocurrency is difficult. Cryptocurrencies have various complex features, and price movements tend to be volatile.

Despite their name, it would be an error to assume that cryptocurrencies should be accounted for as cash. This is because the standard outlined in IAS 7 and IAS 32 imply that cryptocurrencies aren’t cash equivalent, especially given that cryptocurrency is still far from gaining comprehensive adoption in global trade. These are early days, however, and firms will become more familiar with the crypto market. In the meantime, the fundamental considerations for evaluating digital assets remain the same.

In 2019, the International Accounting Standards Board (IASB) concluded that cryptocurrency meets IAS 38 definition of an intangible asset and where it is held for sale in the course of ordinary business, it falls under IAS 2 Inventories.

Both the IASB and the Financial Accounting Standard Board (FASB), which governs the generally accepted accounting standards of the United States, agreed that there is currently no clear path to universally address this subject. Instead, accountants need to consider the substance and financial impact of digital assets to determine their accounting treatment.

Auditors are responsible for providing sufficient evidence relevant to the board’s assertions on the fair presentation of the financial statements. But because of the nuanced concept of regional difference, the way advanced resources are evaluated is distinctly unique.

Be prepared for what’s next

The crypto market can be volatile and unpredictable, but this recent downturn is simply a reminder to financial backers that cryptoassets come with increased risk and unpredictability – particularly during the monetary and political fragility we’re facing right now.

As with any quickly changing technology, you need to keep your finger on the pulse, stay informed and be prepared. You never know what new development might be around the corner and what the benefits could be to your firm and your clients.

If your goal as an accountant is to become a trusted adviser to your clients, you should keep abreast of developments in this dynamic, unpredictable, and potentially rewarding field.

Pretino Albury, a certified CPA, is an experienced finance professional with expertise in management consulting, risk advisory, public accounting, and auditing. He has worked with prestigious organizations, helping them identify risks, develop risk management strategies, and implement effective controls. With a varied industry background, including financial services, power, tourism, and consumer business, Pretino brings a wealth of knowledge to his work.

If you would like to understand more, please get in touch.